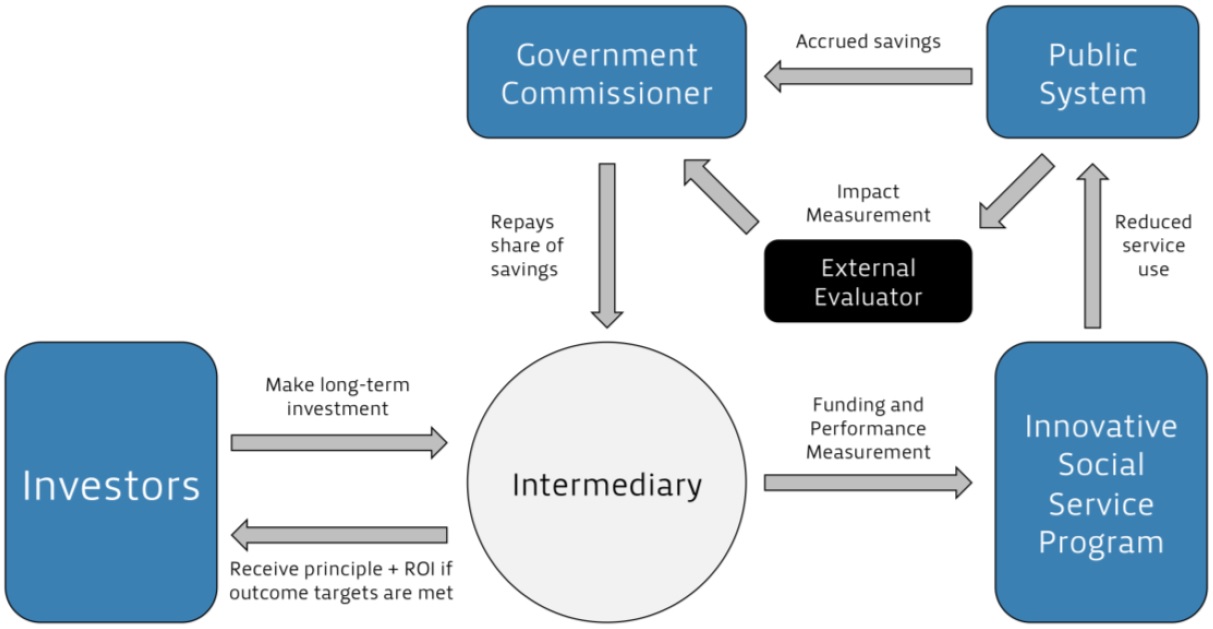

Private investors provide the risk capital necessary to finance programming, and government repays investors for long term positive outcomes. This structure makes SIBs the ultimate pay-for-performance contracts.

The SIB model privately funds a service intervention in the short term, accruing savings to the public in the long term. If outcome targets are met, a portion of these public savings are returned to the private investors who provided the operating capital necessary to fund the initial intervention.

This pay-for-performance funding structure privatizes the risk of innovative program delivery and socializes its benefits.

A Government Commissioner guarantees repayment of investor principle and return contingent on programmatic outcomes being achieved over the lifetime of the SIB.

Private Investors provide upfront and ongoing capital to the intermediary responsible for coordinating the provisions of support interventions.

An SIB Performance Management Intermediary is accountable for the achievement of the social outcome. It manages investor funds and provides leadership and oversight to the various contracted social services.

Service Providers are contracted by the intermediary to deliver a specific service intervention according to an evidence-based model selected prior to the commissioning of the SIB. Providers are ideally contracted into specific roles, providing the intermediary organization flexibility in achieving the desired outcome over the lifetime of the SIB.

A Third Party Evaluator provides objective measurement and verification services to determine whether outcome payments from the commissioner are to be made. This evaluator collects data and performs pre-determined statistical analyses to determine the effects of treatment on the target population.

Download Pay-for-Performance Partnerships to learn more about social impact bonds as funding tools for supportive housing and other innovative social programs.