Purpose and Outcomes

- To build an understanding of shared-equity ownership options.

- To inform the development of culturally legitimate forms of Indigenous ownership that are compatible with the requirements of financial institutes.

Overview

This is one module within a broader toolkit intended to facilitate the goals and projects of First Nations communities related to housing and homelands governance. Each module can be used individually in connection with other supporting modules, or in conjunction with the toolkit as a whole-system approach.

One of the common solutions put forward to resolve the challenges of First Nations housing is the creation of ownership structures for individuals that can enable increased access to financing and individual wealth accumulation. While the privatization and individualization of First Nations land may offer some economic benefits in the short term, for many First Nations the creation of legal structures that resemble fee simple property is not a desirable pathway toward housing and land security.

This module introduces the idea of shared equity as a potential hybrid model of ownership for Indigenous communities that seek to balance cultural and collective values with the housing and economic well-being of the individual.

What is Shared Equity?

Equity, in this context, refers to the financial value that exists within residential property as a result of invested cash and labour in relation to market demand. Typically, this value lies solely with an individual owner, along with the rights and responsibilities associated with private property. In many Indigenous communities, standard private ownership is either not possible due to the collective status of the land, or not desirable due to the possibility of losing control of traditional lands in cases of sale or default.

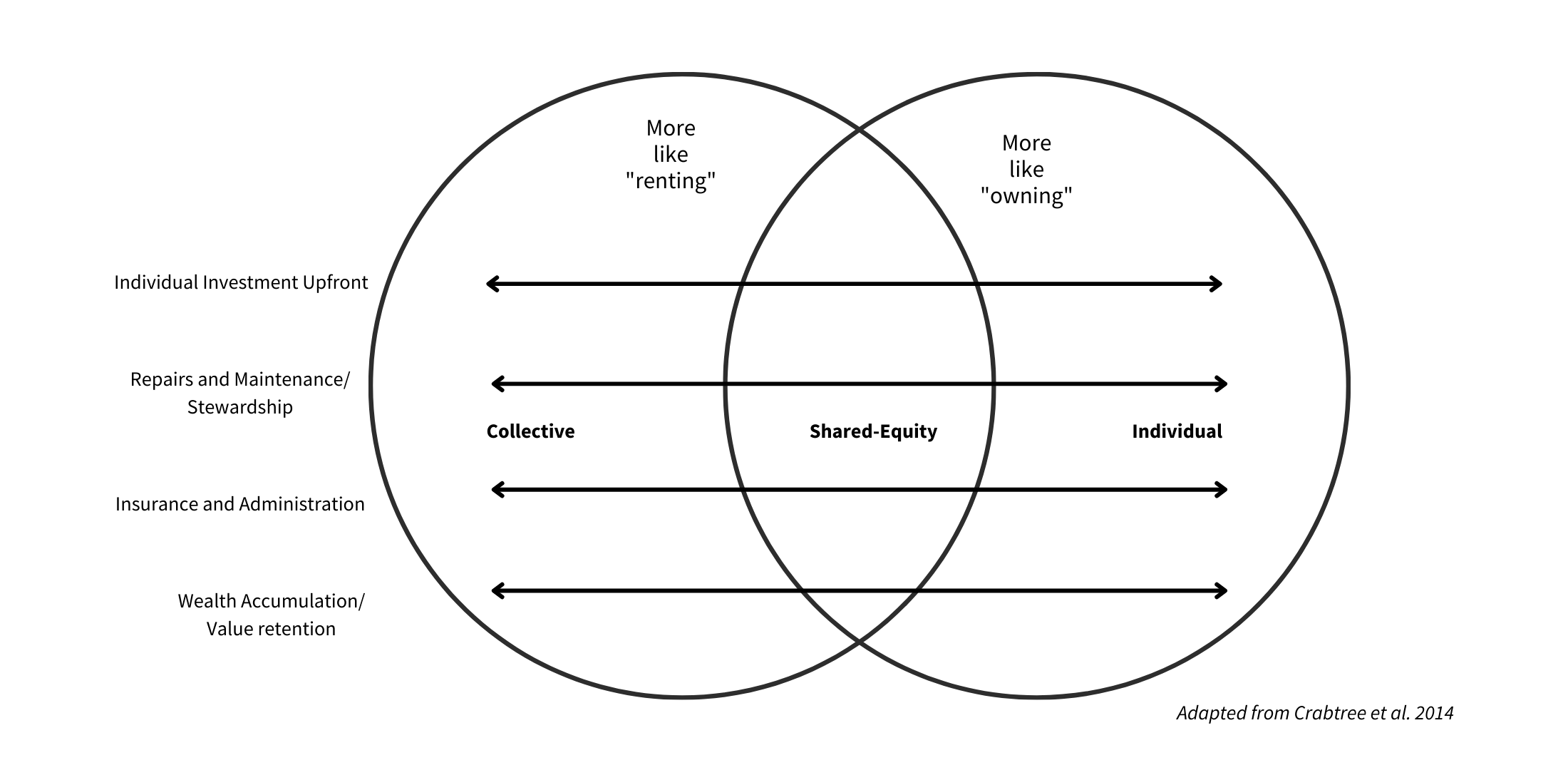

Shared equity seeks to distribute this value, and the associated rights, responsibilities, and risks between individual homeowners and another party representing the interests of a larger community. The main advantage of this is that it allows the cost to be split between the resident and a lender/investor so that an individual or a family, which might otherwise not be able to afford the full purchase price for a home, can begin building value in their home rather than solely paying rent, which accumulates no value for the renter.

Shared equity can be thought of as an intermediate option that falls somewhere between rental housing and individual home ownership.

Under a shared-equity model, a property is purchased jointly by the to-be-resident and the investor at a ratio that can be decided by them. If for example, the purchase price is $100,000 and a family can afford 30% of this amount at $30,000, then the investor will pay the remaining 70% at $70,000. This will usually entitle the investor to 70% of the value if the house is sold as well as payments at a rate of 70% market rent per month. So, if the house would normally cost $1,000 per month to rent, then in this arrangement the resident would only pay $700 in rent to the investing party as they’re essentially paying the other $300 to themselves as part-owner. The $300 then goes into the value of their home, which they will receive via their 30% share if they ever choose to sell.

This also allows for those without a significant amount of money available to pay an up-front down-payment to enter the real estate market and begin building wealth. Where someone might not be able to secure a mortgage from a bank in the full amount for a home, they may be able to secure a $30,000 loan to enter a shared-equity arrangement. This allows a portion of someone’s monthly payments to be diverted away from rent and into something that amounts to savings.

This approach can then be boot-strapped as, after 10 years of payments, their 30% share of the home is likely significantly more than the sum of 30% of their payments, giving them the option of selling and using the income from their share to reinvest in another property at a larger ownership ratio, eventually building to the full ownership of a home.

The assumptions in this approach are that there is a healthy housing market with a large number of buyers and sellers, and that there will be an increase in the value of the home over time. While this is not difficult to find in most major urban centres, when it comes to Indigenous communities where there is a collective entitlement to land that cannot be alienated, or the community is so remote as to see little change in property value, then the model needs to be adjusted.

Where this approach can have value for Indigenous communities is where the investor-entity, which is sharing in the costs and benefits of the home, is an institution created for this purpose within the community itself. The shared-equity approach can allow for community members to invest what resources they have so that they can effectively reduce rent and build an investment over time without needing to meet the high financial bar of a full purchase/home-build price. Simultaneously, the community investment body sees a growth in resources as the properties they invest in mature. Over time this means comes full-circle with more money available for the community investment body to invest in more shared-equity arrangements with members. Depending on the resources available to the community at the outset this may need to be scaled down at first but the potential for growth over time is clear.

Next Steps

- To understand how to begin to develop shared-equity ownership models in your community, see the module on Community Land Trusts.

- Reach out to the Indigenous Home-Lands initiative at Ecotrust Canada. We’re ready to offer support to First Nations partners interested in delving further into any of the concepts presented here. To learn more, contact us via https://ecotrust.ca/priorities/home-lands/